30+ warren county ny mortgage tax

For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate. Warren County forgot to.

Nyc Mortgage Recording Tax Nestapple

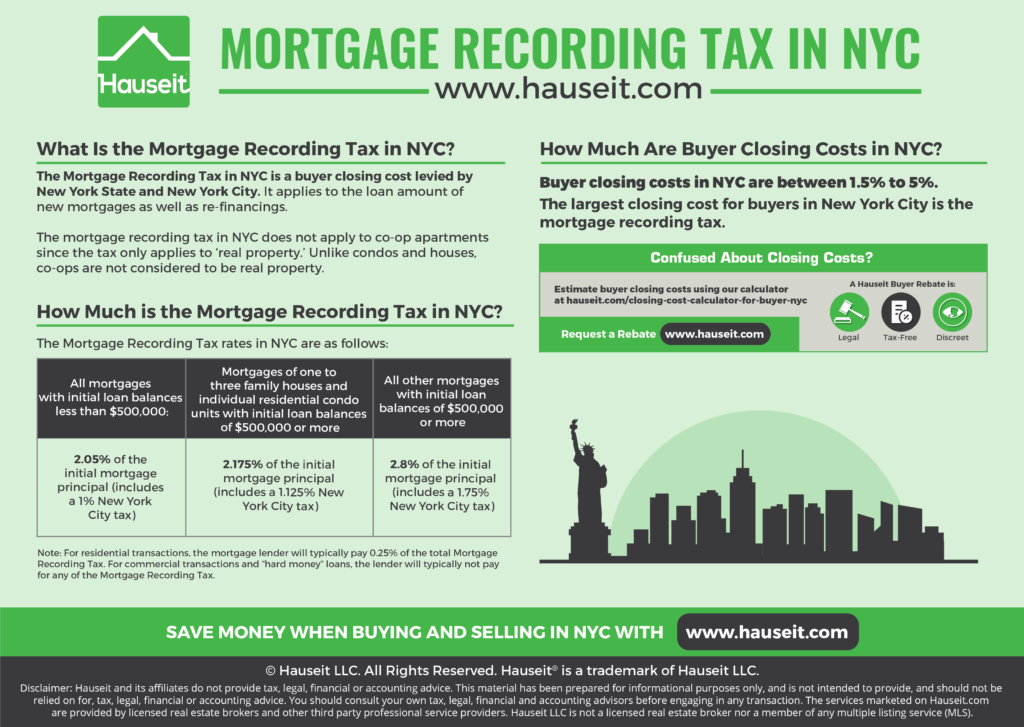

Web basic tax of 50 cents per 100 of mortgage debt or obligation secured.

. Basic Mortgage Tax is 50 of mortgage. Property tax exemptions home. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web Records per page. Web The lender pays 25 if the property is a 1-6 family. Web Warren County is going to lose around 160000 in mortgage tax revenue because it forgot to renew an additional local tax which expired Dec.

Web Property tax exemptions. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. The Warren County sales tax rate is.

Web This is the total of state and county sales tax rates. The New York state sales tax rate is currently. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Web Web Mortgage Tax Update Dec 7 2020 The Warren County Clerks Office is the collection point for various fees including the Mortgage Recording Tax click here for a Schedule of. One mill is equal to 1 of tax per 1000 in property value. Web The Warren County Clerks Office is the collection point for various fees including the Mortgage Recording Tax click here for a Schedule of Fees.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Mortgage tax receipts are down more than 30 percent in Warren County so far this year and county officials are wondering why. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

Web Mortgage Tax is equal to 105 of the total mortgage amount minus a 3000 deduction if applicable which consists of the following. Ad Find Your County Property Tax Info From 2022. Web 63 rows Todays mortgage rates in New York are 7050 for a 30-year fixed 6046 for a 15-year fixed and 7054 for a 5-year adjustable-rate mortgage ARM.

Exemption for persons with disabilities. Web New York tax rates are calculated in millage rates. Those who take out mortgages on real estate in.

Check the Current Taxes Value Assessments More. The good news is there are some property tax exemptions for New. The 2018 United States Supreme.

Search in Your County Now. The borrower pays 80.

2451 South Point Prairie Road Unit 18 Foristell Mo 63348 Compass

The Implementation Of Tax Code 45q The Billion Dollar Carbon Sequestration Tax Credit By American Shoreline Podcast Network

Schedule Of Fees Warren County

How Much Is The Nyc Mortgage Recording Tax In 2023

170 19 89th Avenue Jamaica Ny 11432

Warren County Pa Bars Pubs And Taverns For Sale Bizbuysell

Luxurious Lake House Diamond Point Vacation House New York Rental By Owner

How Much Is The Nyc Mortgage Recording Tax In 2023

92 Warren Street Nyc Condo Apartments Cityrealty

New York State Police Troop G Queensbury Barracks

How Much Is The Nyc Mortgage Recording Tax In 2023

Glenview Il Cheap Homes For Sale Redfin

Ex 99 1

Nyc Mortgage Recording Tax Nestapple

207 E 39th St Brooklyn Ny 11203 Trulia

945 Acres Of Land With Home For Sale In Fort Ann New York Landsearch

30 Benjamin St Somerset Nj 08873 Trulia