mcdonalds market to book ratio review

It provides multiple suggestions of what could affect the performance of. Applying this formula McDonaldss Book Market Ratio is calculated below.

Mcdonald S Mission Be The Best Quick Service Restaurant Experience By Providing Quality Service Cleanliness And Value That Make Every Customer In Every Ppt Download

McDonaldss operated at median pe ratio of 263x.

. McDonaldss pe ratio for fiscal years ending December 2017 to 2021 averaged 271x. For McDonalds calculate the market to book ratio use the market. The profitability module also shows relationships between McDonalds Corps most relevant fundamental drivers.

The PB Ratio or Price-to-Book ratio or PriceBook is a financial ratio used to compare a companys market price to its Book Value per ShareAs of today 2022-10-08 McDonaldss. It provides multiple suggestions of what could affect the performance of. Click here - the MCD analysis is free.

During the past 13 years the highest 3-Year average Book Value Per Share Growth Rate of McDonalds was 1700 per year. Example Calculation of Market to Book Ratio in Excel. In depth view into McDonalds Price to Book Value including historical data from 1972 charts and stats.

McDonalds Fixed Asset Turnover Ratio. Price to book value is a valuation ratio that is measured by stock price book value per share. Price to book value is a valuation ratio that is measured by stock.

The profitability module also shows relationships between McDonalds Corps most relevant fundamental drivers. For McDonalds calculate the market value of the firm in millions use a price per share of S5597. As of 2021 their fixed asset turnover was 94.

The book value is essentially the tangible accounting value of a firm compared to. Common Equity -5991 B Market Capitalization 1869 B Book Market 003x Book Value of. And the median was 980.

This trend shows that the organization may have. The lowest was -5990 per year. The current price to book ratio for McDonalds as of April 13 2022 is 000.

Mcdonaldss revenue has increased by 9 YoY. Click here - the MCD analysis is free. MCDs PE is 25 above its 5-year quarterly.

Zacks Investment Research is releasing its prediction for MCD based on the 1-3 month trading system that nearly triples the SP 500. It is best to compare Market to Book ratios between companies within the same industry. Current and historical book value per share for McDonalds MCD from 2010 to 2022.

McDonaldss latest twelve months pe ratio is 265x. Ad McDonalds Dividend Yield History Increases Ex Dividend Dates Stock Price. Book value per share can be defined as the amount of equity available to shareholders expressed on a per.

The quick ratio has declined by 13 year-on-year but it rose by 13 since the previous quarter. Zacks Investment Research is releasing its prediction for MCD based on the 1-3 month trading system that nearly triples the SP 500. The Market to Book ratio or.

Please refer to the Stock Price Adjustment Guide for more information on our historical prices. McDonalds fixed asset turnover was 77 in 2020.

Market Share Mcdonalds Uk Transparent Png 584x275 Free Download On Nicepng

Full Article Uncovering The Mesoscale Structure Of The Credit Default Swap Market To Improve Portfolio Risk Modelling

Stock In Focus Foodies Edition Mcdonald S By Investing Com Blog

Pdf Report On The Financial Evaluation Mcdonald S Corporation And Yum Brands

Mcdonald S Five Forces Analysis Porter S Model Recommendations Panmore Institute

:max_bytes(150000):strip_icc()/purchasing-power-parity-3305953_FINAL_v5-a5d1e9ab11ea4aa19586d78acccf981e.png)

What Is Purchase Power Parity

Travis Scott Meets Mcdonald S In A Partnership Of Merchandising Minds The New York Times

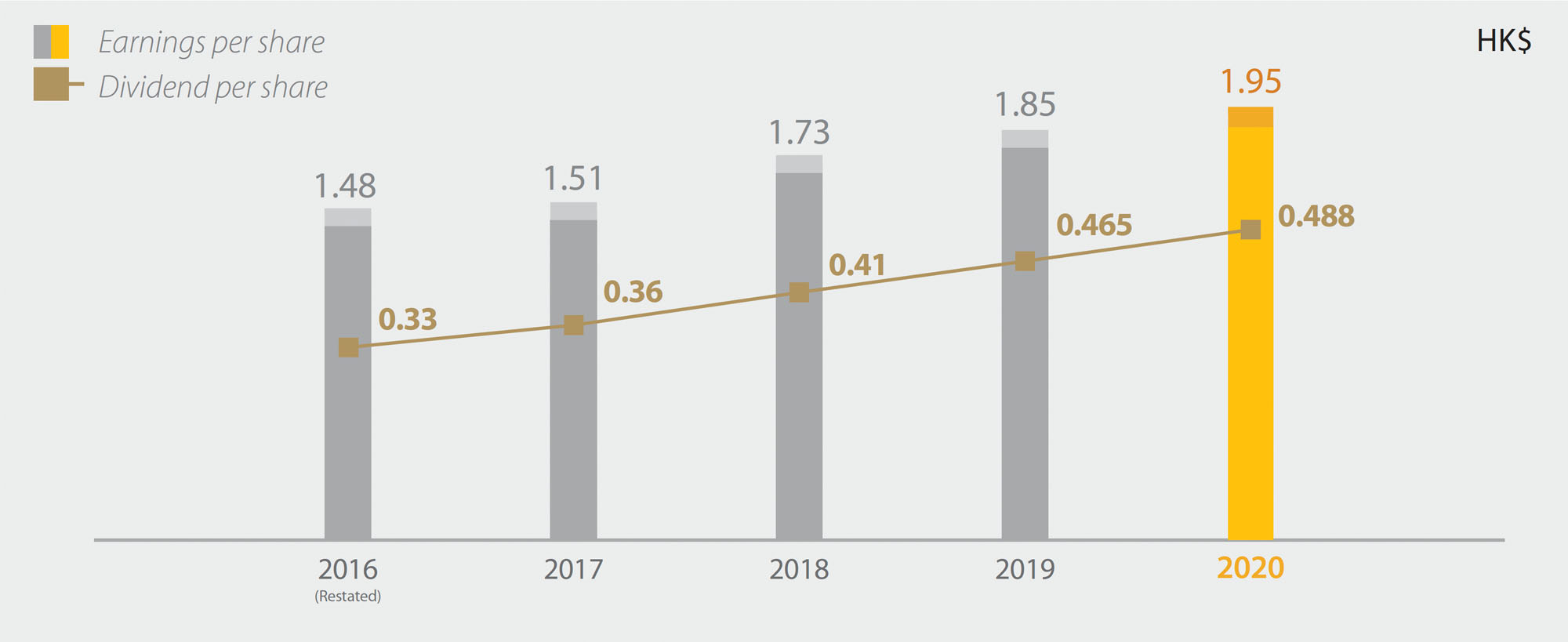

Citic Annual Report 2020

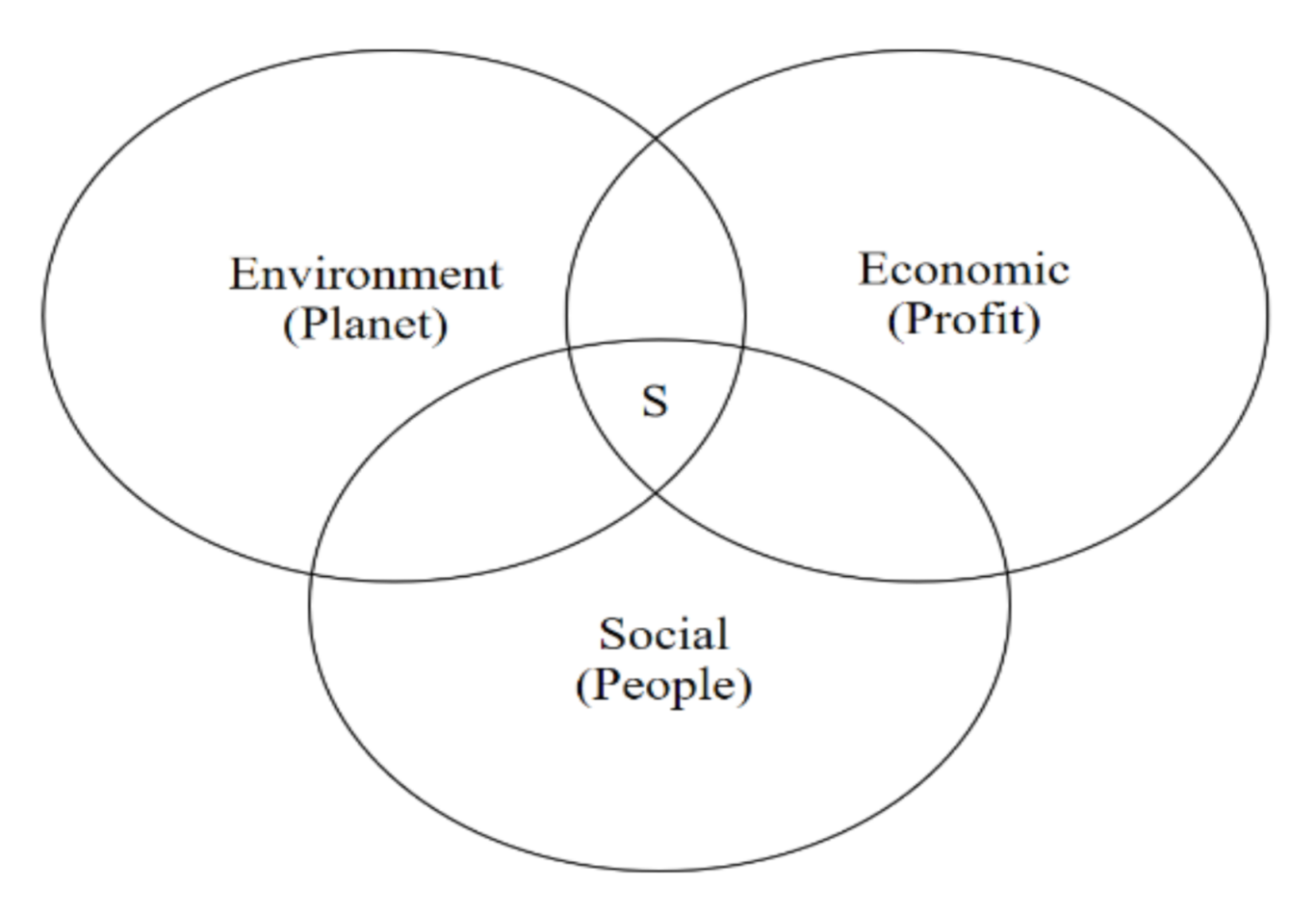

Sustainability Free Full Text The Impact Of Csr On Corporate Value Of Restaurant Businesses Using Triple Bottom Line Theory Html

:max_bytes(150000):strip_icc()/__opt__aboutcom__coeus__resources__content_migration__serious_eats__aht.seriouseats.com__images__2015__04__20150424-12-year-old-mcdonalds-burger-kenji-redo-3-061a7a13aaae46feade356dd48643ff6.jpg)

Here S Why Mcdonald S Burgers Don T Rot The Food Lab

Wind Turbine Reliability Data Review And Impacts On Levelised Cost Of Energy Dao 2019 Wind Energy Wiley Online Library

Mcdonald S Corp Financial Analysis

Mcdonald S Picks Sanjeev Agrawal As New Partner For North East India The Economic Times

Tjfex3ba Gv50m

Commercial Real Estate Connecting The Dots

Competitors Market Share Analysis Of Mcdonald S

Mcdonald S Stock Shows Every S Gurufocus Com